EVERFI

Program to Offer Student Financial Learning Opportunities

December 9, 2022

Financial Literacy Standards are required to be met by secondary schools across the state of Indiana. This policy was implemented in October 2011 by the Indiana Department of Education. However, PHS recently realized the curriculum offered here falls short in meeting the curriculum imposed by the state.

There are six different criteria schools must meet in order to deem their students financially literate: financial responsibility and decision making, relating income and careers, planning and money management, managing credit and debt, risk management and insurance and saving and investing.

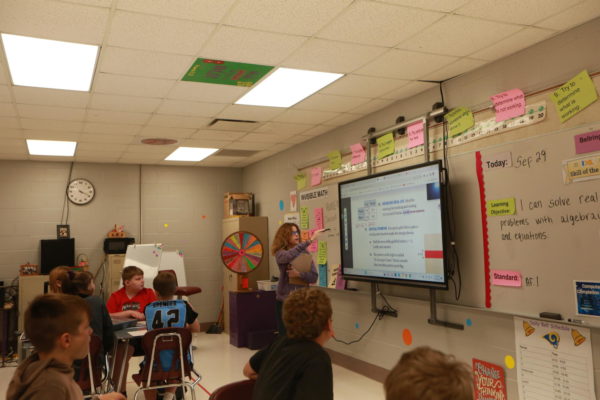

The majority of these benchmarks are currently covered in two different courses, College and Careers Teacher Dutch Parks’s eighth grade college and career readiness class and Social Studies Teacher Neil Dittmer’s economics class. Parks and Dittmer collaborated to check off the standards met by their coursework and were tasked with identifying the ones not covered as of now.

After this list was compiled, a program was chosen to help supplement these shortcomings: EVERFI. According to their website, EVERFI works in “helping organizations tackle intractable social issues by providing the missing layer of education.”

“We have a program called EVERFI which is a digital online platform in which students can log on and do digital lessons and learn. It can be things from if a student had questions on FAFSA, how to do a checkbook, taxes. Anything along those lines,” said Assistant Principal Adam Stroud.

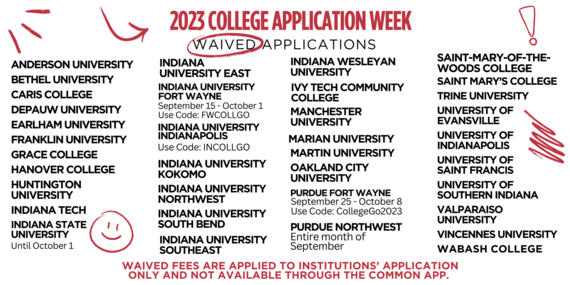

This program is coming to PHS in the spring for a trial run with seniors. Seniors will have the opportunity to complete modules during homeroom while students in other grades work on AVID and SAT prep.

This program will be implemented fully in the coming school year and will cover not only financial topics, but also more mathematical ones like basic algebra. In the future, these lessons will likely be applied in the regular classroom as well.

“The overarching goal is to allow our students to leave here and be financially equipped to understand planning for their future. We get some kids that get into FAFSA issues. We get into issues where students don’t know the appropriate way to take their money and invest it. The goal here is to make a more financially savvy community so that they can be ready for their future,” said Stroud.

Visit the Indiana Department of Education website to read the full, detailed Financial Literacy Standards framework.